By Helmut Wagner

Read or Download Implications of Globalization for Monetary Policy PDF

Best globalization books

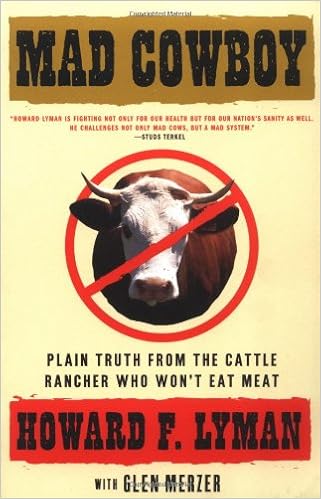

Mad Cowboy: Plain Truth from the Cattle Rancher Who Won't Eat Meat

Howard Lyman's testimony at the Oprah Winfrey exhibit published the lethal impression of the farm animals on our future health. It not just ended in Oprah's announcement that she'd by no means devour a burger back, it despatched surprise waves via a involved and susceptible public.

A fourth-generation Montana rancher, Lyman investigated using chemical compounds in agriculture after constructing a spinal tumor that almost paralyzed him. Now a vegetarian, he blasts in the course of the propaganda of pork and dairy pursuits -- and the govt. firms that defend them -- to reveal an animal-based nutrition because the fundamental reason behind melanoma, middle sickness, and weight problems during this state. He warns that the farm animals is repeating the error that resulted in Mad Cow affliction in England whereas at the same time inflicting severe harm to the surroundings.

Persuasive, simple, and whole of the down-home solid humor and optimism of a son of the soil, Mad Cowboy is either an inspirational tale of non-public transformation and a powerful name to motion for a plant-based nutrition -- for the nice of the planet and the well-being folks all.

When Globalization Fails: The Rise and Fall of Pax Americana

IS GLOBALIZATION AN unintentional RECIPE FOR conflict?

Taking this question as its start line, James Macdonald's while Globalization Fails deals a wealthy, unique account of warfare, peace, and exchange within the 20th century—and a cautionary story for the twenty-first.

In the past due 19th century, liberals exulted that the unfold of overseas trade may herald prosperity and peace. An period of financial interdependence, they believed, could render wars too high priced to salary. yet those desires have been dashed via the carnage of 1914–1918. looking the protection of monetary self-sufficiency, countries grew to become first to protectionism after which to territorial growth within the 1930s—leading back to devastating clash. Following the second one international struggle, the globalists attempted once again. With the communist bloc disconnected from the worldwide financial system, a brand new foreign order used to be created, buttressing loose exchange with the casual supremacy of the USA. yet this benign interval is coming to an finish.

According to Macdonald, the worldwide trade in items is a combined blessing. It makes countries wealthier, but in addition extra weak. And whereas fiscal interdependence pushes towards cooperation, the ensuing experience of financial lack of confidence pulls within the contrary direction—toward repeated clash. In Macdonald's telling, the 1st international War's naval blockades have been as very important as its trenches, and the second one international battle might be understood as an inevitable fight for important uncooked fabrics in an international that had rejected loose alternate. this present day China's monetary and armed forces enlargement is undermining the Pax Americana that had saved monetary insecurities at bay, threatening to resurrect the aggressive multipolar global of the early 20th century with all its attendant hazards. Expertly mixing political and monetary historical past and enlivened via shiny citation, while Globalization Fails recasts what we all know concerning the earlier and increases important questions about the longer term.

Carolyn Nordstrom explores the pathways of world crime during this attractive paintings of anthropology that has the ability to alter the way in which we expect concerning the global. to write down this ebook, she spent 3 years touring to sizzling spots in Africa, Europe, Asia, and the U.S. investigating the dynamics of unlawful exchange round the world--from blood diamonds and fingers to prescribed drugs, exotica, and staples like nutrients and oil.

There are nearly 1000000000 grownup illiterates on the earth. grownup literacy courses in constructing international locations are usually ineffectual and particularly constrained results. to enhance results, a lot emphasis has been given to empowering nongovernmental firms, expanding learner motivation, and reinforcing social merits.

Additional resources for Implications of Globalization for Monetary Policy

Sample text

2000)). S. equities. All the studies mentioned here, however, agree that it is appropriate to respond to asset prices (including exchange rates) in some way; however, the question is open whether expected inflation serves as a sufficient statistic for the effects of asset prices on welfare, so that, given expected inflation, there is no role for asset prices in monetary authorities’ reaction functions. C. Increase in the Uncertainty About the Transmission Mechanism Increase in the use of e-money We have defined globalization as a process of growing economic interdependence which results partly from the rapid and widespread diffusion of new technologies.

Now, as a consequence of the nominal rigidities, variation in nominal demand induces variation in real output, when downward rigidity is binding. Hence, it may appear appropriate to adjust monetary policy with a stronger concentration on output stabilization. And indeed, central banks are often pressured to concentrate, in such a situation, on other targets such as stabilizing output or employment. In Euroland, the Maastricht Treaty, for example, is often interpreted as requiring this from the ECB.

Even without this obligation, central bank money (currency) will not vanish as it has the advantage, as against emoney, of absolute anonymity, which is important for many people when carrying out cash payments. Moreover, currency is and will be the only riskless asset which implies the ultimate source of confidence. 76 See Woodford (2000a). Woodford argues that central banks can successfully steer economies even in a world where cash is disappearing. The reason is that a central bank can set monetary policy by controlling interest rates (by lending/borrowing e-money above/below the current market interest rate), rather than by altering the currency supply.